Top Lending Protocols on Cardano

Cardano’s decentralized finance (DeFi) ecosystem is rapidly evolving, and lending protocols are at the heart of this transformation. These platforms empower users to borrow and lend assets in a secure, decentralized manner, unlocking liquidity and creating new opportunities for financial growth. In this blog, we’ll explore four standout lending protocols on Cardano: Levvy, Fluid Tokens, Liqwid, and LenFi.

1. Levvy

Levvy, managed by Angel Finance, is an innovative peer-to-peer lending protocol that allows both NFT and Fungible Token (FT) owners to unlock liquidity effortlessly. This protocol stands out by creating opportunities for assets of all sizes, rather than focusing solely on larger collections.

Key Features:

- NFT and FT Collateral: Borrowers can use their NFTs or FTs as collateral to access loans without selling their assets.

- Competitive Lending Terms: By fixing interest rates and loan durations within the protocol, Levvy ensures lenders compete on loan value, giving borrowers the best possible opportunities.

- Manual Foreclosure: Borrowers benefit from a manual foreclosure process, offering a brief window to resolve issues before the loan is foreclosed.

Levvy’s emphasis on flexibility and accessibility makes it an essential component of Cardano’s growing DeFi landscape.

2. Fluid Tokens

Fluid Tokens is a trailblazing platform on the Cardano blockchain, offering an open, trustless, and secure ecosystem of financial services. Fluid Tokens caters to the needs of crypto users by enabling non-custodial DeFi solutions driven by community feedback and innovation.

Key Features:

- P2P Lending: Users can borrow liquidity in any currency by using their NFTs or fungible tokens (e.g., $HUNT, $MIN, $SNEK) as collateral. Lenders, in turn, can earn interest by providing loans in ADA or stablecoins.

- Liquidity Pools: Lenders can establish liquidity pools for specific NFT collections or tokens, offering pre-set terms for loans that borrowers can access automatically.

- Renting: An innovative protocol enabling token holders to rent assets such as utility tokens, NFT memberships, or metaverse items for various use cases.

- Boosted Stake: Unique functionality that allows users to leverage ADA staking power for enhanced voting rights, staking rewards, and ISPO benefits.

- Buy Now, Pay Later: Users can purchase NFTs and tokens at a discounted price and pay via smaller installments over time.

- Aquarium: Simplifies smart contracts by enabling transaction fees to be paid in custom tokens and automating contract operations.

Fluid Tokens exemplifies versatility and innovation, making it a cornerstone of Cardano’s DeFi ecosystem.

3. Liqwid

Liqwid is a cutting-edge, non-custodial liquidity protocol that enables users to lend and borrow Cardano native assets (CNAs). Built on Cardano’s secure and transparent blockchain infrastructure, Liqwid offers a seamless DeFi experience.

Key Features:

- Overcollateralized Loans: Borrowers can access liquidity without selling their assets, ensuring financial flexibility.

- Lombard Loans: Borrow against staked ADA without losing staking rewards.

- Community Governance: The platform operates as a DAO, giving users a voice in its development.

Liqwid’s focus on security, transparency, and user empowerment makes it a cornerstone of Cardano’s DeFi ecosystem.

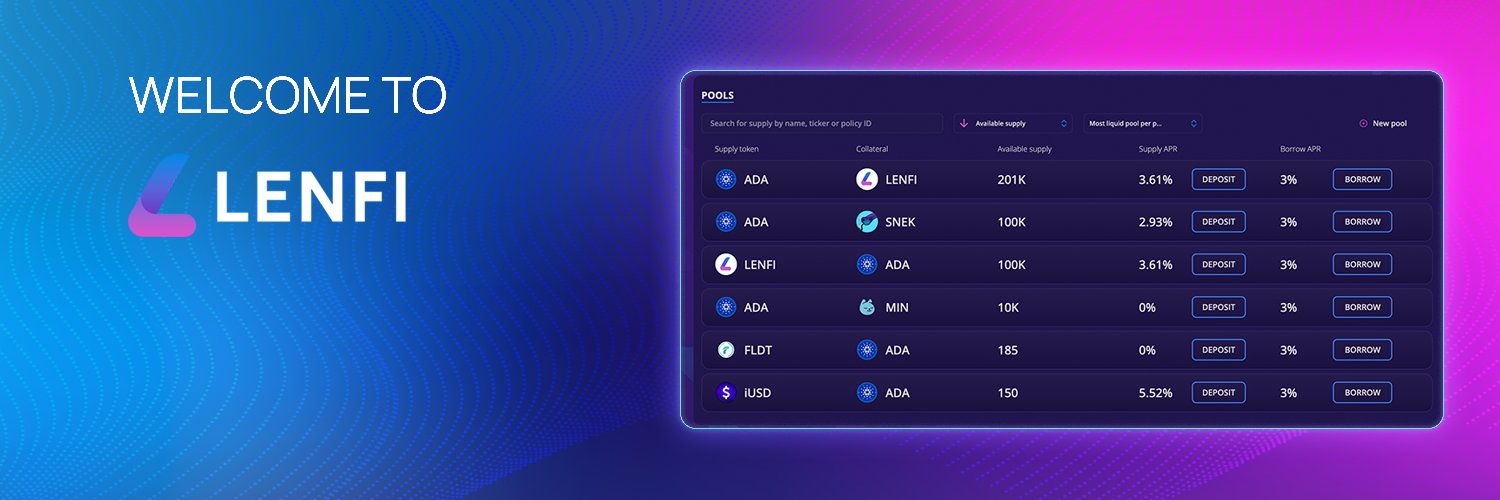

4. LenFi

Formerly known as Aada Finance, LenFi is a decentralized lending protocol that leverages Cardano’s eUTxO model to offer a seamless borrowing and lending experience.

Key Features:

- Permissionless Liquidity: Users can create their own liquidity pools and manage them independently.

- NFT Bonds: A unique feature that allows users to tokenize their loans as NFTs.

- Overcollateralized Loans: Ensures the safety of lenders by requiring borrowers to deposit more collateral than the loan amount.

LenFi’s innovative features and commitment to decentralization make it a standout platform for DeFi enthusiasts.

Why Lending Protocols Matter

Lending protocols on Cardano are more than just financial tools—they’re gateways to a decentralized future. By enabling secure, transparent, and efficient lending and borrowing, these platforms are driving the adoption of DeFi on Cardano.

Whether you’re an NFT collector, a liquidity provider, or someone looking to access funds without selling your assets, platforms like Levvy, Fluid Tokens, Liqwid, and LenFi offer tailored solutions to meet your needs.

As Cardano’s ecosystem continues to grow, these lending protocols will play a pivotal role in shaping the future of decentralized finance.

Download and experience Tokeo on Android and iPhone here.